PrimeXBT Trading Platform

Visit PrimeXBT to experience a world of flawless online trading where excellent security and user-friendly design coexist. Gain access to a wide range of trading instruments, outstanding leverage options, and lightning-fast execution.

Trading involves risk.

PrimeXBT Trading Options

PrimeXBT is a flexible platform with a wide range of trading options. Trade cryptocurrencies, forex, commodities, and indices (CFDs). Take a look at these trade opportunities:

Copy Trading

Take use of PrimeXBT’s copy-trading ability to start a cooperative trading trip. Showcase your knowledge as a strategy manager by compiling an accessible asset pool that other people can follow. Followers can take advantage of this chance to automatically duplicate profitable deals, enabling them to make passive profits without actively trading the market.

Followers easily copy the transactions made by Strategy Managers, who take the lead and regulate the trading activity of their managed strategies. A win-win situation is produced by this mutually beneficial relationship: followers of a strategy generate passive income without requiring active trading, and strategy managers receive a portion of the profits created by their followers.

One of PrimeXBT Copy-Trading’s main characteristics is:

- Risk management: By putting strong risk management plans into place, strategy managers can guarantee a safe and regulated trading environment for all players.

- Transparent Performance indicators: This promotes trust and well-informed decision-making by giving Followers and Strategy Managers access to real-time, transparent performance indicators.

- Diverse Asset Coverage: Get a thorough trading experience by investigating a variety of assets through copy-trading, such as cryptocurrencies, forex, commodities, and indices.

Crypto Trading

With PrimeXBT, you can dive headfirst into the exciting world of cryptocurrency trading, where obtaining coins or tokens entitles you to a portion of digital assets like Bitcoin. Until you’re ready to sell, keep your money in a digital wallet, custodian, or cryptocurrency exchange. This makes cryptocurrency trading a flexible and strategic endeavour.

Perspectives on PrimeXBT’s Trading of Cryptocurrencies:

- Ownership of Digital Assets: Trading cryptocurrencies on PrimeXBT gives traders ownership of their digital assets, enabling them to take advantage of the ever-changing market trends.

- USD as the Reference Point: On PrimeXBT, cryptocurrency trades frequently occur against the US dollar, offering a common valuation benchmark.

- Spot Trading Excellence: Take advantage of your trading methods by entering the realm of spot trading on PrimeXBT, where you may execute deals at the current market price.

- Fundamental Security: Whether your digital assets are stored in a digital wallet, custodian, or exchange, protect them with PrimeXBT’s secure platform.

Margin Trading

You can use margin trading to leverage money given to you by a third party for asset purchases. Take your trading to the next level with PrimeXBT’s margin trading accounts, which provide unique advantages.

Important PrimeXBT Margin Trading Features:

- Extensive Trading Pairs: Access more than 600 trading pairs, including well-known cryptocurrencies like BTC, ETH, BNB, USDT, and more. Because of PrimeXBT’s broad range, you can investigate different marketplaces on a single platform.

- Trade Responsibly: Utilise PrimeXBT’s user-friendly interface to manage your transactions and engage in responsible trading. Effectively manage your positions to ensure that you are trading with strategy and knowledge.

- Trade Fees That Are Competitive: Savour the finest transaction costs for top-notch assistance. PrimeXBT is dedicated to provide you access to an affordable trading environment so you can optimise your profits.

- High Liquidity: The superior transaction depth provided by PrimeXBT Margin Trading increases liquidity and promotes a more seamless trading experience. Trade with assurance, knowing that the platform is there to assist your market activity.

Stock Trading

Investing in stocks provides a dynamic way for investors to interact with the market, regardless of whether they are lured to the prospect of capital growth, dividend income, or voting rights.

Discover the many advantages of common and preferred shares at PrimeXBT, where possibilities to take advantage of the world of stock trading are just waiting to be discovered.

Common Stock:

- Capital Growth: When the price of stocks grows, you can earn from possible sales of your shares.

- Dividend Income: Several corporations offer their shareholders tax-efficient income in the form of dividends.

- Voting Privileges: By having voting rights, you can influence corporate choices to some extent.

- Liquidity: You can quickly access your investments by easily buying and selling common shares for cash.

- Advantageous Tax Treatment: Take advantage of reduced capital gains and dividend income tax rates.

Preferred Stock:

- Continual Income Stream: Get a set dividend amount with preference over common stockholders.

- Increased Income: Benefit from preferential tax treatment and dividends that are significantly higher than those of common shares.

- Variety: Take a look at the several kinds of preferred shares; each has special characteristics like convertible options or unpaid dividend accumulation.

Registered users

1 million+

Daily trades

170k+

Countries served

152

Trading platforms

2

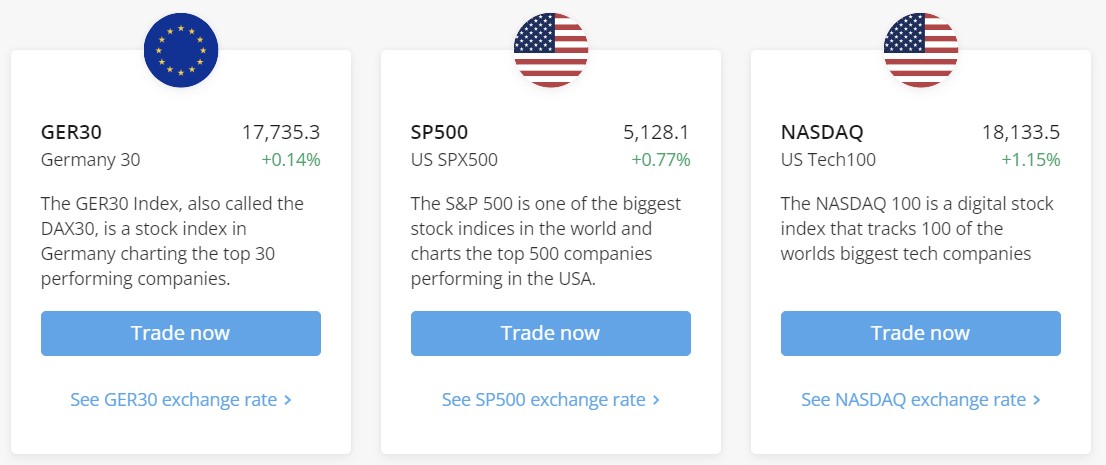

Markets for PrimeXBT

As you go through a wide choice of offerings that have been carefully chosen to enhance your trading experience, discover and unlock new possibilities. The markets at PrimeXBT are entry points to a world of financial opportunities, not merely routes.

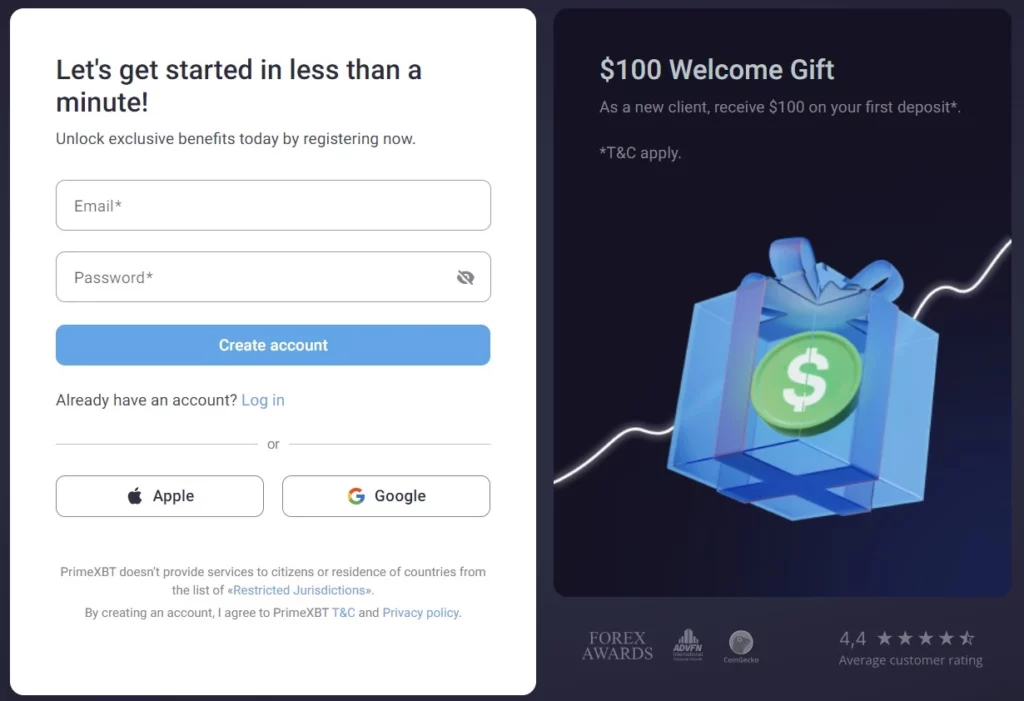

Sign up for the Trading Platform PrimeXBT

It’s easy to get started with PrimeXBT; just complete our quick registration form:

- Go to the PrimeXBT website.

- In the upper right corner of the website, click the register icon.

- Choose your login credentials by entering your email address and coming up with a strong password. Please accept our terms and conditions and, if you would like, provide your phone number for additional security.

- To begin the registration procedure, click the “Register” button.

- Enter the 4-digit PIN code that was sent to your email address to quickly confirm your registration.

Best wishes! As of right now, you are a member of the PrimeXBT community and prepared to take advantage of all the benefits our platform has to offer. Cheers to your trading!

PrimeXBT KYC

At PrimeXBT, we’re committed to giving traders the best possible circumstances and possibilities while upholding the highest standards in the financial sector. Our processes and infrastructure are carefully designed with the protection of personal data as our top priority, demonstrating our unwavering dedication to privacy.

Recognising the importance of Know Your Customer (KYC) processes, we stress that all clients follow PrimeXBT policies and take reasonable precautions to comply with local laws and regulations. The process of Customer Due Diligence (also known as CDD) can be started at any moment in order to confirm the identity of the person or the source of the funds, protect against fraud, and make sure that AML regulations are followed.

Industry-standard financial monitoring techniques are a part of our KYC/AML rules, which help us spot any activity that would call for a second CDD assessment. Possible abuse of our services or a suspected breach of our terms and conditions are examples of situations that could start a CDD procedure.

PrimeXBT reserves the right to require certain paperwork in the event that a CDD procedure is started, including proof of identity, proof of address, and proof of source of funds. Trading or deposit/withdrawal restrictions may be put in place temporarily until the necessary paperwork is submitted and the CDD procedure is effectively finished.

Questions? Our 24/7 support team here to help

Download the PrimeXBT app on iOS and Android

Take charge of your transactions from anywhere with the PrimeXBT app, which can be downloaded on iOS and Android devices. With the app in hand, you may trade FX, commodities, stock indices, cryptocurrencies, and global markets with ease, all from the comfort of your mobile device.

Trade from anywhere at any time, and be informed about the markets that are most important to you. With the PrimeXBT app, you can trade with power at your fingertips and make sure you never pass up an opportunity in the fast-paced world of finance. Improve your mobile trading experience by downloading now.

PrimeXBT Bonus Offers & Rewards

Trade using PrimeXBT’s incentives and perks. These prizes go above and beyond the norm, giving you extra advantages.

Bonus for Signing Up

Make a $500 minimum deposit within the first 48 hours to claim $100.

To take advantage of this exclusive welcome bonus:

- Create an Account: Set up your account to start using PrimeXBT.

- Make a Deposit: To breathe new life into your trading endeavours, fund any of your individual PrimeXBT wallets with a $500 or greater deposit.

- Transfer Money: Before the offer expires, move the money quickly to your trading account to increase your trading power.

Programme for Referrals

The PrimeXBT referral programme is your ticket to easy extra money.

Go to “Hub” and choose “Referral Programme” to get to it.

Receive payments from trading commissions that your referrals give you when you use a special link. Send it to friends or post it online. Note that only PrimeXBT accounts are eligible for the programme.

Make use of the hierarchy’s four levels:

- Direct Referrals: 20% payout

- Level 2: 15%

- Level 3: 10%

- Level 4: 5%

Bonus with No Deposit

We don’t currently provide a no-deposit bonus.

Still, there are a tonne of other alluring advantages that our platform offers, such a welcome bonus, a variety of awards, and a number of trading options on international markets.

Investigate the numerous perks and bonuses offered by PrimeXBT as you start your trading career to improve your overall experience.

PrimeXBT Promo Codes (2024)

PrimeXBT promo codes are available in a number of ways. Important resources include the official website, particularly for sign-up bonuses for new users, and email newsletters, which frequently have special offers.

Unique promo codes may also be offered by affiliate partners such as financial bloggers and influencers. PrimeXBT’s social media pages on Facebook and Twitter are excellent places to keep an eye out for news about events and special deals that may involve discount codes.

To activate a promo code on PrimeXBT, sign in to your account, use the “Margin” tab, or navigate to the “Hub” area and input the code under “Promo code.” Choose the relevant margin account, input the promo code, and hit “Activate” on the “Margin” page. Keep in mind that every promo code has unique guidelines, so make sure to read them before using.

Make the most of PrimeXBT promo codes to tailor your trading to your tastes and financial objectives!

- Trade Fee Discounts: By providing unique alphanumerical codes that result in lower trade fees, promo codes enable you to optimise your trading potential while keeping expenses to a minimum.

- Advantages of Overnight Lending: Take advantage of cheap financing for the entire night, so you may maximise your trading positions with more financial freedom.

- Deposit Bonuses: With the use of promo codes, increase your trading capital with deposit bonuses. With the extra money these bonuses give you, you can take on bigger bets and possibly increase your profits.

Accepted Payment Options

Use PrimeXBT for hassle-free choices for deposits and withdrawals. Discover a whole new level of freedom as you handle your money with ease. Deposits and withdrawals in well-known cryptocurrencies like BTC, COV, ETH, USDC, and USDT are supported by PrimeXBT. Additionally, users can easily transact in US dollars.

It’s easy for people who don’t already own any PrimeXBT Crypto to acquire digital assets. Use Coinify, SEPA transfers, credit/debit cards, or other methods to quickly add cryptocurrency to your portfolio. Select PrimeXBT for a flexible and easy-to-use payment method.

Deposit Methods

PrimeXBT provides several alternatives for making deposits:

- Straightforward cryptocurrencies through wallets;

- Fiat money using Perfect Money and AdvCash;

- Bank cards for cryptocurrency purchases;

- Support for several blockchain networks.

Withdrawal Methods

PrimeXBT provides a number of withdrawal options, such as:

- Withdrawals of cryptocurrency to individual wallets;

- Withdrawals of fiat money through AdvCash and Perfect Money services;

- Local payment methods available in some nations;

- Additional withdrawal methods.

Trading Fees for PrimeXBT

PrimeXBT has affordable trading fees; for the majority of trades, it charges just 0.05%, and for cryptocurrency futures, it offers discounted prices. It provides accurate prices for different assets and distinguishes between maker and taker fees to enhance market liquidity.

Associated and Prohibited Nations

With pride, PrimeXBT provides traders all over the world with a state-of-the-art platform for financial opportunities. Nonetheless, our services are prohibited in several regions. There are certain nations where users and citizens cannot access PrimeXBT services:

- United States of America

- United States Minor Outlying Islands

- Canada

- Algeria

- American Samoa

- Cuba

- Ecuador

- Iran

- Japan

- Myanmar

- North Korea

- Russian Federation

- Sudan

- Syria

- Saint Vincent and The Grenadines

Although PrimeXBT seeks to offer an open and accessible trading environment, certain regions may not be able to get all services due to legal and regulatory constraints.

Ready to start?

Traders Reviews

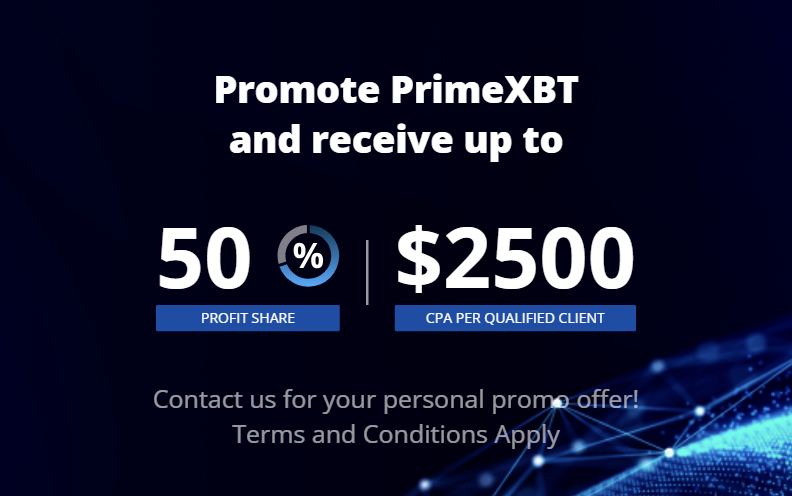

PrimeXBT Affiliate Program

Through the PrimeXBT affiliate programme, people can increase their income by encouraging their audience to check out PrimeXBT. Affiliates can earn up to 50% profit share and $2500 for each referred client, depending on the deal they choose.

A broad spectrum of partners are supported by the programme, such as experts in affiliate marketing, owners of media resources, educational institutions, and dealers with vibrant communities.

Contact Information

Customer service is the top priority for the PrimeXBT team.

Please contact us with any questions you may have about our products, services, security, or business opportunities.

| Contact Method | Details |

| Online Chat | Click on Chat in the Account menu for live chat support. |

| Email Support | Reach us 24/7 at [email protected] |

| PrimeXBT Official Social Media | Facebook, Twitter, Telegram, Youtube, Reddit |

| Telegram Support Bot | Use the PrimeXBT Telegram Bot for live chat support. |